The evolving landscape of Fintech - 2020 and Beyond

Verticalized fintechs in spacetech and sustainability | Digital assets platform | Federated Bank platforms | Challenger banks growth | New models in retirement asset/financial planning and more

Published first on LinkedIn in 2019

Historians (and some would say the wise) will tell you that the best way to predict the future is to study history (and statistics perhaps). The postulate holds for predicting the future of fintech which has for a decade and some seen tremendous growth and wealth creation. In this first of a series of blogs, I look at the different generations and mega trends that have shaped fintech and financial services and make some predictions on the evolution and where some of the next big opportunities are for startups, incumbents and technology/internet firms.

The existing models in fintech

Fintech today has seen over $150 Billion in investment and more than 40 startups with unicorn status (over $1B in valuation). It is the disruption segment which has has seen the most entrants; from startups, to incumbent financial institutions, and technology companies and large domestic and international internet firms. The disruption has been broad based on user experience, distribution, cost to serve, and in some cases on technology drivers. I see four distinct models each in its own state of evolution and growth:

The digital customer journey generation fintechs that removed friction and lowered costs especially in consumer finance. Paypal did to payments what OnDeck, Kabbage did to small business lending and Wealthfront to the wealth advisory business to name a few representative examples.

The neoBank platforms and open banking generation - End-to-end digital, embedded and outside in Banking. All major financial institutions have an API channel today and several technology companies operate with a Bank license. Marcus from Goldman Sachs, solarisBank in Germany are notable examples.

The digital assets and digital securities generation fintechs - Distributed ledgers have the potential to fundamentally upend the recording, custody and transfer mechanism of assets - the very essence of financial services. There have been several ups and downs in this area with crypto-currencies but I think we have only realized the tip of the iceberg when it comes to its potential. Cryptocurrencies, and permissioned blockchains like Ripple, Provenance, Bitcoin are all examples in this space.

The global expansion of fintech - fintech is a global phenomena today with opportunities in Asia, South America and Africa. Certain fintech areas like payments, financial inclusion have more growth opportunities overseas than in the US.

These models are not mutually exclusive and startups, incumbent financial institutions or internet firms that capture the value across these models tend to have the greatest valuation and success.

6 mega trends and predictions across these fintech models for 2020 and beyond

1. Digital customer journey fintechs go for scale - SoFI recently purchased naming rights to a football stadium in Los Angeles; harbinger of times to come for SoFI and consumer fintechs to go for scale by becoming a household brand? I think so. It is all about scale for these first generation fintechs.

Market share of challenger banks. alternative lenders and roboadvisors are small when compared to Banks consequently the big focus for these firms in 2020 and beyond will be more deposits, more loans and more assets under management and diversification

2020 will see more community banks and credit unions partner with fintechs and challenger banks. Partnership models will include white labelling as well as providing banking and settlement services.

2. Payments growth is overseas for US fintechs - in Asia, South America and Africa - Square’s Jack Dorsey wants to temporarily relocate to Africa ostensibly to set up Square Africa based on Bitcoin. Payment innovators like Marqeta are expanding to Asia and South America. Rapyd, a fintech out of London, is a platform for global commerce with focus on cardless customers.

Most of the ride share companies like Grab in Singapore, GoJek in Indonesia are pivoting as a digital payment platform including Uber the original company of this kind. For US payment fintechs the growth is overseas in Asia, Africa and South America. According to McKinsey projection the global payment revenue by 2022 in Asia Pacific is almost three times that in North America.

Facebook’s Libra which was a bold effort is likely not going to take off in the foreseeable future due to regulatory scrutiny and public relations challenges. Blockchain based cross-border payment networks which was one of the first blockchain use case a few years ago has had several entrants building their own networks. Number of participants in the network and integration into treasury and other Bank systems will drive growth for these players. While there is unlikely going to be a winner here, financial institutions will come together on some standards around cross-ledger settlement and cross-border payments and settlement will become a standard on distributed ledgers around the globe with potential to increase transparency and disrupt the currency derivative business.

3. Expect new innovations and models in retirement assets management (401k/IRA) and financial planning - Digital financial planning is an area I expect more developments in 2020. We saw a large M&A in that space this year, including one of the largest bank in the U.S announcing new leadership and focus on wealth management for 2020. Expect incumbents, roboadvisors to integrate financial planning into their offerings and some consolidations and M&A in this area.

A significant fintech opportunity in wealth management is around better planning and deployment of assets in retirement plans (401ks, IRAs etc). To put things in perspective, 401k plans in the U.S together hold almost $6 Trillion in assets and typical fees (including paid through investment expenses) is about 1% of assets so that is $60 Billion in revenue (this does not include the almost $10 Trillion in IRAs and variety of other retirement plans). There have been a few fintechs in this area such as Guideline, Betterment's retirement products. While some of these options are very competitive in pricing, it is a conceivable a Robinhood type free business model can disrupt this space as there is sufficient scale and economics on the backend.

4. Challenger bank models will diversify into lifestyle applications - Funding and valuation for challenger banks saw a rise in 2019 and will continue in 2020. The relatively high interest, zero cost (even no overdraft fees in some cases), integrated PFM type/loyalty rewards type features have a strong appeal to all segments. The valuation of these challenger banks are similar to that of technology companies (as opposed to a community or mid-sized bank) due to high gross profit margin. There are at least 6 challenger Banks that have unicorn status ($1 Billion+valuation) some closing the Decacorn ($10 Billion+ valuation) status. While all this seems great news to be a challenger bank challenges with penetration and deposits share remain. In order to get more adoption, acceptance and, differentiation not only from traditional banks but also other challenger banks, these firms will not only have to diversify into other financial products but offer (or integrate with existing) lifestyle services like in platforms like WeChat (in China) and SnapChat, Facebook messenger to sustain engagement. The business model/valuation is similar to internet firms like Google, Facebook where valuation is based on active engaged users which requires a broader set of capabilities in the long run even though some of these firms have revenue through interchange on debit card transactions.

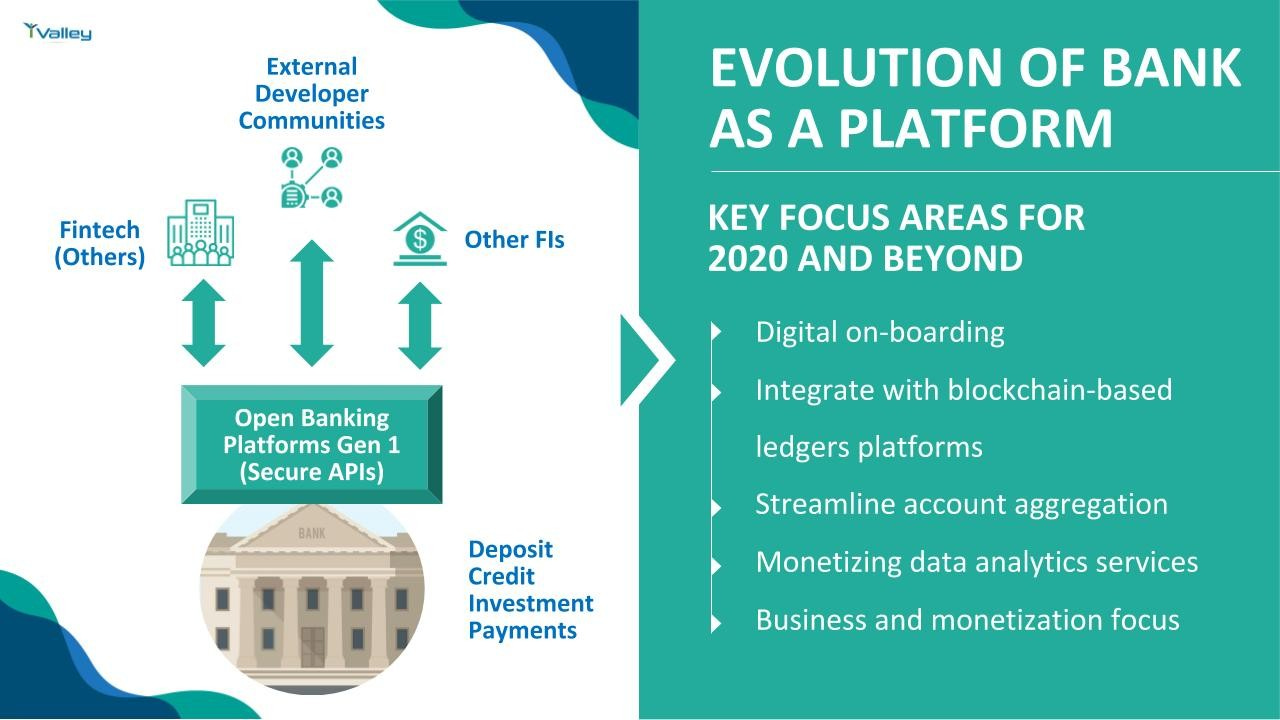

5. The Bank as a Platform operating model continues to gain traction with neoBank platforms having more success than traditional Banks- Goldman's Marcus, solarisBank in Germany are fintech and banking platforms built from ground up. These groups operate as a technology company with a Banking license. Open Banking or API Banking as a channel has seen widespread implementation esp. in Europe due to regulatory requirements. All major US banks have implemented such capabilities with outreach to developer and startup communities (I wrote about the API Opportunity in Banking back in 2014). Challenges remain around monetization and revenue impact from Open Banking due largely to a lack of business and revenue focus in these initiatives.

Recent developments in cloud computing along with core fintech capabilities that are becoming cloud native can potentially change the impact of platformization in Banking. Capabilities such as core banking, risk and compliance services, data analytics services across data sets, account data aggregation services and distributed ledger interoperability services could evolve open banking platforms to be more like their modern counterparts like Marcus and solarisBank. Banks should carefully evaluate their platform roadmap strategy with considerations for:

Digital on-boarding for startups and developers

Participate as a node in distributed ledger networks in a federated model

Streamline account aggregation through federation with other FIs and leveraging cloud native aggregation capabilities

Monetizing data analytics services

Define business and revenue KPIs.

Few developments that I want to highlight are AWS’ Data Exchange which may evolve and and provide an alternative to standard aggregators and Microsoft Azure capabilities on providing ledger interoperability will create the foundation for interoperable distributed system of records (DSOR) in the Cloud.

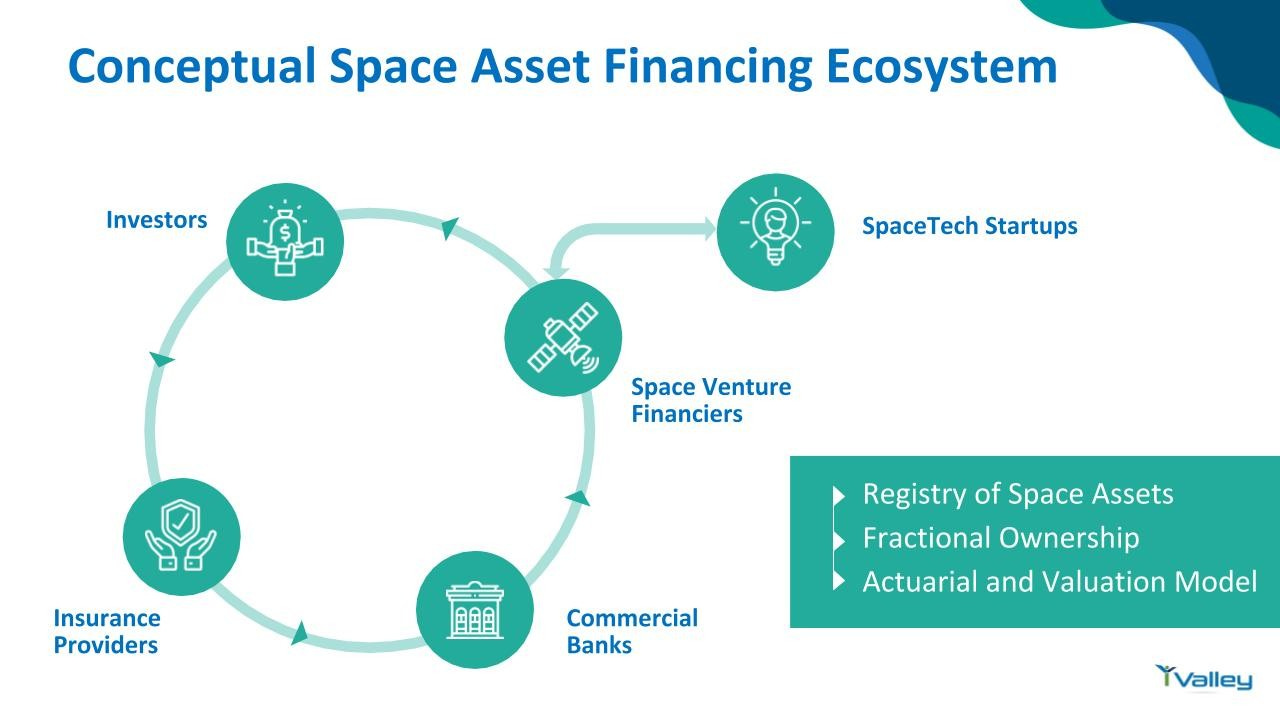

6. Digital assets and digital securities platform will evolve- Cryptocurrencies were taking the oxygen out of Blockchain innovation but since the crypto-winter we have seen several permissioned blockchain successes. Prominent among them Figure based on the Provenance blockchain which is a new entrant into the unicorn status. These platforms deliver the promise of creating and transferring assets within an immutable secure blockchain network with favorable economics. Over time with critical mass of these immutable records not only can systemic risks be identified easily, but credit rating, insurance underwriting and in general capital markets could also benefit or even get dis-intermediated.

Such decentralized platforms are well suited for other areas such as SpaceTech and Climate (sustainability) registries and financing models. For example, a registry of space assets with actuarial and valuation model as a foundational framework of space financing and insurance or a sustainability network of ecosystems that track assets and the actors operating on those assets (terrestrial mining, fisheries and such) to create more transparency in such sub-systems. Watch out for more on this in this space from iValley in 2020.

Tell me what you think about all this. I will be writing about each of these areas in some detail in the coming weeks and iValley will be publishing trend reports for our corporate innovation program subscribers and will cover these topics at our annual conference FINTECHTALK™ in fall of 2020.

If you are interested in receiving more information about iValley’s corporate innovation programs or becoming a sponsor of FINTECHTALK™ , please contact info at ivalley.co or message me.

Paddy Ramanathan is Founder and Managing Director of the iValley Innovation Center in the East San Francisco bay area. iValley Innovation Center (http://www.ivalley.co) is a corporate FinTech accelerator and host of FINTECHTALK™. iValley's mission is to incubate and catalyze the development of big ideas and innovation in fintech.